Apple Pay itself has no spending limit, but individual banks and retailers may impose their own limits. Always check with your bank and retailer for specific restrictions.

Apple Pay offers a seamless way to make payments using your Apple devices. It’s convenient, secure, and widely accepted, making it a popular choice for many users. Understanding any potential spending limits is important to avoid transaction issues. While Apple Pay doesn’t enforce a strict cap, banks and merchants might have their own rules.

Checking these limits beforehand ensures a smooth payment experience. Apple Pay continues to evolve, integrating with more financial institutions and retailers, enhancing user convenience. Always stay updated with your bank’s policies to maximize your Apple Pay usage.

Introduction To Apple Pay

Apple Pay has revolutionized the way we make payments. It offers a secure and convenient method for transactions. This digital wallet service by Apple integrates seamlessly with your Apple devices.

What Is Apple Pay?

Apple Pay is a mobile payment and digital wallet service. It allows users to make payments using their Apple devices. Users can store their credit and debit card details securely.

With Apple Pay, you can use your iPhone, iPad, Apple Watch, or Mac. It enables contactless payment using Near Field Communication (NFC) technology. This means you can pay by simply holding your device near a payment terminal.

Popularity And Usage

Apple Pay’s popularity has grown rapidly worldwide. It is now available in over 50 countries. Many retailers and online stores accept Apple Pay.

According to recent statistics, millions of people use Apple Pay daily. It is known for its security features and ease of use. Users appreciate the convenience of not carrying physical cards. Below is a table showing Apple Pay’s usage statistics:

| Year | Active Users (in millions) |

|---|---|

| 2018 | 127 |

| 2019 | 227 |

| 2020 | 383 |

| 2021 | 507 |

Apple Pay’s security is one of its strongest features. It uses Touch ID, Face ID, and passcodes to authorize payments. This makes it difficult for unauthorized users to access your account.

Apple Pay also offers cashless and contactless transactions. This has become increasingly important in a world moving towards digital solutions. Many people prefer Apple Pay for its user-friendly interface and quick transactions.

Credit: support.apple.com

Setting Up Apple Pay

Setting up Apple Pay is a straightforward process. It lets you make secure payments with your Apple device. This guide will help you get started with ease.

Device Compatibility

First, check if your device supports Apple Pay. Here is a list of compatible devices:

- iPhone models with Face ID or Touch ID, except iPhone 5s

- iPad models with Touch ID or Face ID

- Apple Watch Series 1 or later

- Mac models with Touch ID or paired with Apple Watch

Ensure your device is updated to the latest iOS, watchOS, or macOS.

Steps To Set Up

Follow these simple steps to set up Apple Pay:

- Open the Wallet app on your iPhone.

- Tap the + sign to add a new card.

- Use your device’s camera to capture the card information.

- Enter any additional details required by your bank.

- Agree to the terms and conditions.

- Wait for your bank to verify your card.

Once verified, you can start using Apple Pay.

For Apple Watch, open the Watch app on your iPhone:

- Tap Wallet & Apple Pay.

- Follow the same steps to add a card.

On a Mac, go to System Preferences:

- Click Wallet & Apple Pay.

- Add your card by following the prompts.

That’s it! You are now ready to use Apple Pay.

Transaction Limits

Apple Pay offers a convenient way to make payments. But, are there any limits? Yes, there are transaction limits to be aware of. These limits help ensure security and manage usage.

Daily Spending Limits

Each day, users can spend up to a certain amount with Apple Pay. This daily spending limit varies by bank and card issuer. Some banks may set a higher limit, while others might have a lower one.

| Bank | Daily Limit |

|---|---|

| Bank A | $1,000 |

| Bank B | $1,500 |

| Bank C | $2,000 |

Per Transaction Limits

There is also a limit for each transaction you make. This per transaction limit ensures secure payments. The limit also varies by the merchant and the bank.

- At some stores, the limit is $100.

- Others may allow up to $200 or $300 per transaction.

It’s best to check with your bank and the merchant. Knowing these limits helps you plan your spending.

Factors Influencing Limits

Apple Pay is a popular way to pay. But, there are limits. These limits depend on various factors. Let’s explore them below.

Bank Policies

Banks have different rules. Each bank sets its own Apple Pay limits. Some banks allow higher limits. Others set lower limits. It is important to check with your bank. They will provide the exact details.

| Bank | Daily Limit | Transaction Limit |

|---|---|---|

| Bank A | $5000 | $1000 |

| Bank B | $3000 | $800 |

| Bank C | $2000 | $500 |

Merchant Restrictions

Merchants also set limits. Some stores have higher transaction caps. Others may have lower limits. The type of store can influence this. For example, a grocery store might have a higher limit than a small boutique.

- Large Stores: Often have higher limits.

- Small Shops: Might have lower limits.

- Online Stores: Limits can vary widely.

Always check with the merchant. This ensures you stay within their limits.

Managing Apple Pay Limits

Managing Apple Pay limits is essential for secure and efficient transactions. Learn how to adjust limits and monitor transactions effectively.

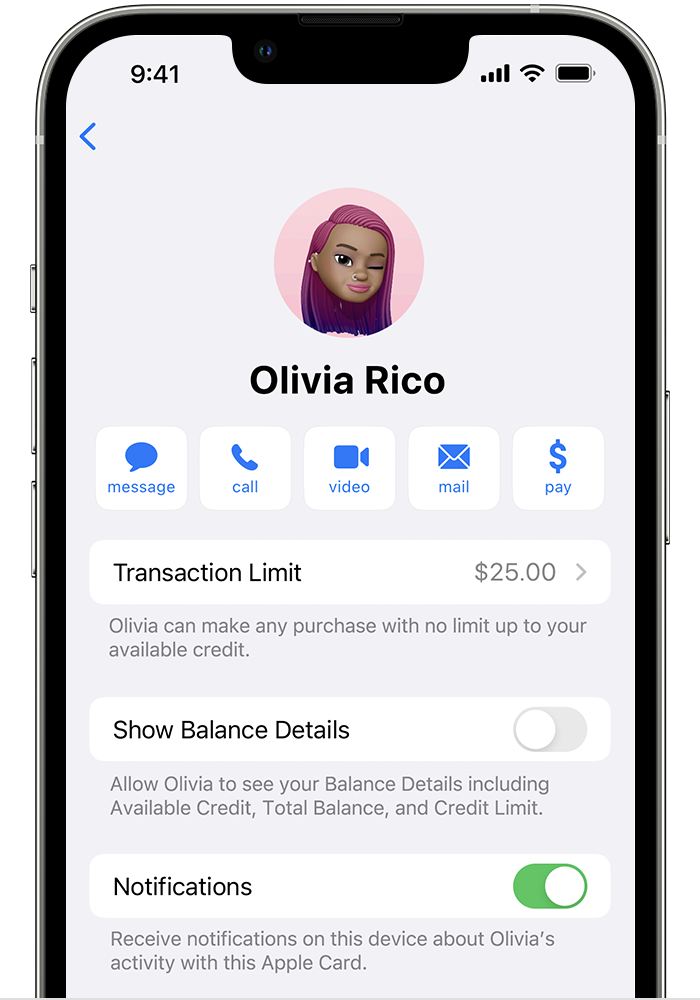

Adjusting Limits

Apple Pay allows users to set transaction limits for better control. Adjusting these limits can help manage spending and avoid overspending.

| Transaction Type | Default Limit | Adjustable |

|---|---|---|

| In-Store Purchases | $1,000 | Yes |

| Online Purchases | $1,500 | Yes |

| Peer-to-Peer Payments | $500 | Yes |

To adjust limits, go to the Wallet app settings. Follow these steps:

- Open the Wallet app on your iPhone.

- Select the card you want to adjust.

- Tap on the three dots in the upper right corner.

- Select “Card Details” and adjust the limit as needed.

Monitoring Transactions

Monitoring transactions is crucial for keeping track of spending. Apple Pay provides detailed transaction history for users.

Follow these steps to monitor transactions:

- Open the Wallet app.

- Select the card you want to review.

- Scroll down to see recent transactions.

Users can also set up notifications for real-time updates. Enabling notifications helps in tracking every transaction instantly.

Monitoring transactions ensures you stay within your set limits. It also helps identify any unauthorized activities quickly.

Security Measures

Apple Pay is known for its robust security measures. These measures ensure your transactions remain safe. Let’s dive into some of these key security features.

Encryption And Tokenization

Encryption and tokenization are the backbone of Apple Pay’s security. Encryption protects your data during transactions. It scrambles the information, making it unreadable to others.

Tokenization replaces your card details with a unique code. This code, or token, is used during transactions. Your actual card number is never shared with merchants. This reduces the risk of fraud and data breaches.

These technologies work together to safeguard your financial information. They ensure your transactions are secure and private.

Two-factor Authentication

Two-factor authentication (2FA) adds an extra layer of security to your Apple Pay account. It requires two forms of identification before you can use Apple Pay. This could be a password and a fingerprint or face recognition.

With 2FA, even if someone knows your password, they cannot access your account. They would also need your fingerprint or face ID. This makes it much harder for unauthorized users to access your account.

Implementing 2FA enhances the overall security of your transactions. It provides peace of mind, knowing your account is well-protected.

Common Issues And Solutions

Using Apple Pay is convenient, but sometimes problems arise. Knowing common issues and solutions can save time. Below are some frequent problems and how to fix them.

Declined Transactions

Apple Pay transactions may get declined for several reasons. Here are some common causes:

- Insufficient Funds: Ensure your linked bank account has enough balance.

- Card Not Supported: Check if your card issuer supports Apple Pay.

- Incorrect Details: Verify your card details are correctly entered.

- Outdated Information: Update your billing address and contact details.

If the problem persists, contact your bank for further assistance.

Troubleshooting Tips

If your Apple Pay isn’t working, try these troubleshooting tips:

- Restart Your Device: Turn your phone off and on again.

- Check Software Updates: Ensure your device has the latest iOS update.

- Re-add Your Card: Remove and re-add your card in the Wallet app.

- Check Network Connection: Ensure you have a stable internet connection.

For persistent issues, visit Apple’s support page or contact customer service.

Credit: support.apple.com

Future Of Apple Pay

The future of Apple Pay looks promising and exciting. With technology advancing quickly, Apple Pay continues to innovate. Let’s explore what lies ahead for this popular payment system.

Upcoming Features

Apple Pay is expected to introduce several new features soon. These features will improve user experience and security.

- Enhanced Security: Advanced encryption methods to protect your transactions.

- Biometric Authentication: Use Face ID or Touch ID for safer payments.

- Expanded Compatibility: Apple Pay will work with more devices and platforms.

These features will make Apple Pay even more reliable and user-friendly.

Market Predictions

Experts predict significant growth for Apple Pay in the coming years. Here are some key market trends:

| Year | Projected Users | Transaction Volume |

|---|---|---|

| 2023 | 500 Million | $2 Trillion |

| 2025 | 700 Million | $3 Trillion |

| 2030 | 1 Billion | $5 Trillion |

These numbers show the growing trust and preference for Apple Pay. Businesses and consumers are adopting this payment method rapidly. Keep an eye on these trends to stay ahead in the market.

Credit: discussions.apple.com

Frequently Asked Questions

What Is The Maximum You Can Pay With Apple Pay?

The maximum payment limit with Apple Pay depends on the merchant and your card issuer. Generally, there is no fixed limit.

Can I Send $5000 Through Apple Pay?

You cannot send $5000 through Apple Pay. Apple Pay has a transaction limit of $3,000 per transfer.

Can You Apple Pay Over $100?

Yes, you can use Apple Pay for transactions over $100. It depends on the merchant’s terminal settings. Always check with the store.

Can I Pay $500 On Apple Pay?

Yes, you can pay $500 using Apple Pay. Ensure your linked card has a sufficient balance. Apple Pay supports large transactions.

Conclusion

Apple Pay offers convenient and secure transactions. While limits may apply, they vary by bank and region. Always check with your bank for specific restrictions. Understanding these limits ensures you make the most of Apple Pay’s features. Stay informed to enjoy seamless digital payments with Apple Pay.